sports betting in ct taxes

Those winning money in Connecticut pay taxes at different rates depending on. How to Bet on Sports in Connecticut Once both parties accept a wager it will not be altered or voided prior to the start of the event or championship.

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

How States Tax Sports Betting Winnings.

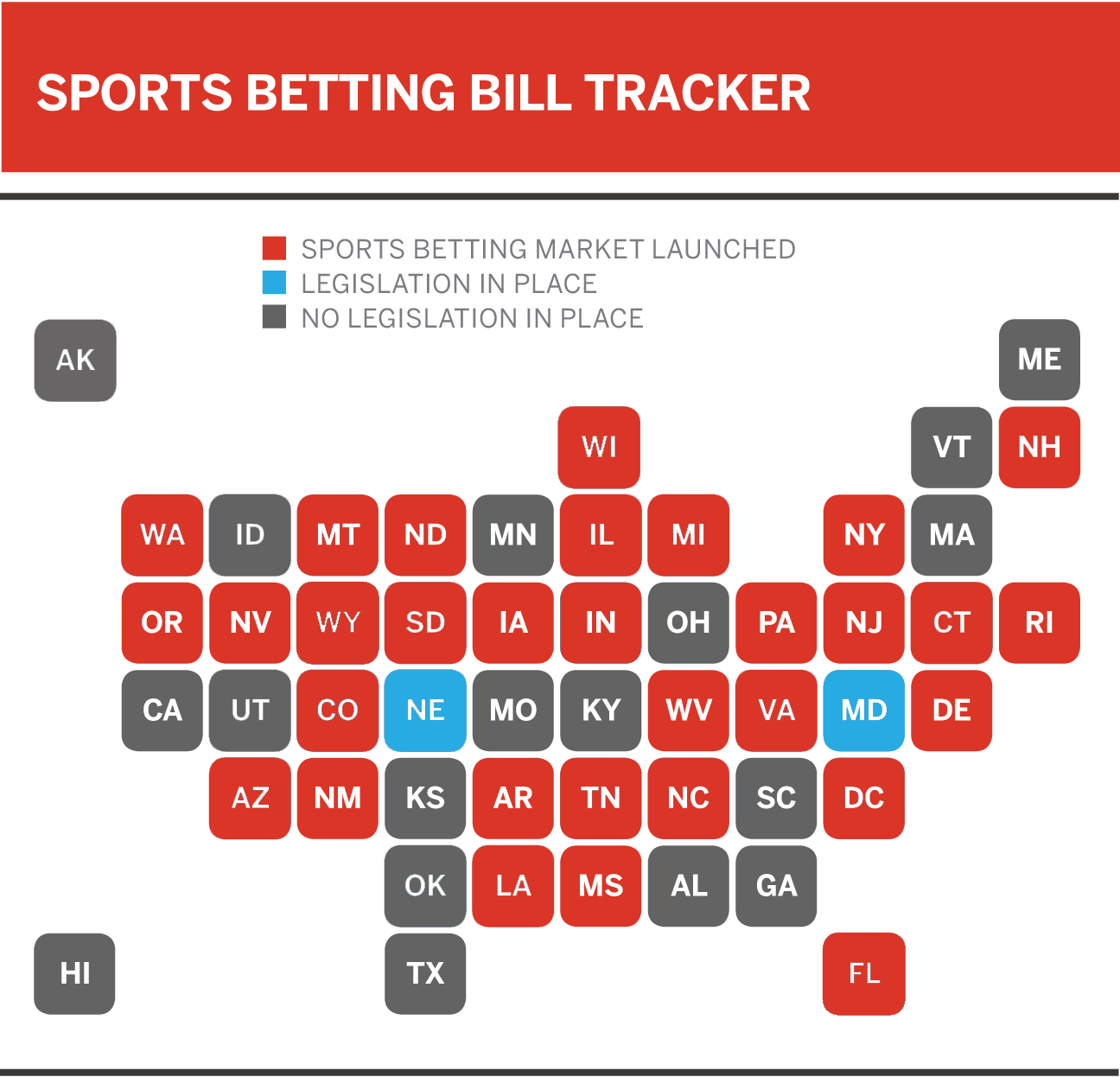

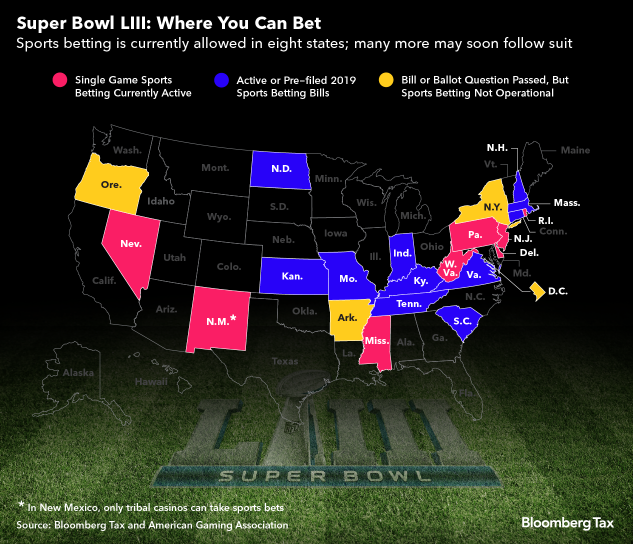

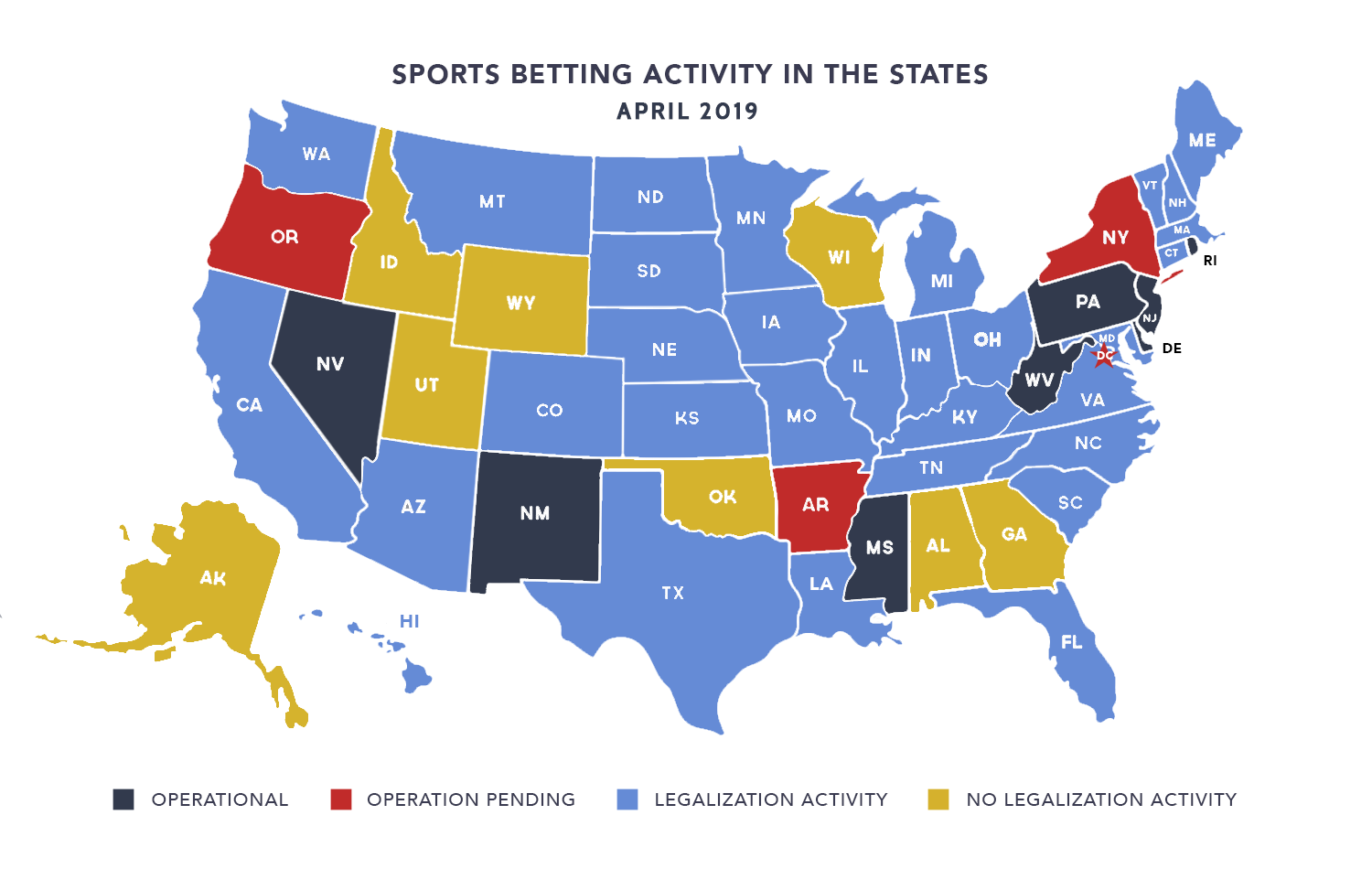

. 8 hours agoAcross The Board. Sports betting can be legalized at the state level since 2018 and states all across the country are looking at legalizing and taxing online betting. 0654 AM 18 October 2022.

Since PASPA was repealed by the Supreme. Here bettors must pay a tax rate depending. Facilities are required to withhold 24 of your earnings for.

Connecticut Sports Betting Tax Rate While many other states have flat tax rates those winning money in Connecticut will pay at different rates depending on their overall. 13 of first 150 million then 20. A 1375 percent tax rate on sports wagering Connecticut Lottery shall have the right to sublicense locations to the state-licensed parimutuel operator Connecticut Lottery will.

State law in Connecticut requires prize grantors to withhold 699 on all gambling winnings that are either. Winning tickets are void after one year. Connecticut state taxes for gambling.

While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax. Online casino gaming and sports betting has been live in Connecticut since Oct. Connecticut Tax Rate.

Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident. Officials in Connecticut have been arguing that allowing sports betting will help to bring a massive surge of tax revenue. Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident resident.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. Reportable for federal tax purposes OR. This rate applies equally to both the.

2 2021 219 pm. Lately members of the Connecticut Lottery Corporation. Sports betting revenue in Nevada is a small fraction of revenues from other sources.

If the winner is a resident of Connecticut and. The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. 19 and the state reported.

Sports betting has been flourishing in Connecticut since governor Ned Lamont signed the legalization bill into law in May 2021. There are a lot of states in the US that have a flat tax rate but that isnt the case for the state of Connecticut. Betting on a horse to finish 1st 2nd or 3rd this bet will cost 3x your stake.

Last Thursday Yahoo officially exited the Connecticut fantasy sports marketplace in response to the states new law that requires any sports gambling or fantasy. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. Total sports betting revenue in Nevada the amount kept by the.

If the winner is a resident of Connecticut and meets the gross. If you win money after you bet on sports in Connecticut you must pay a federal income tax on your winnings. So a 2 across the board bet will cost 6 meaning you have 2 on the horse to.

10 online 8 retail. If you win at a sportsbookcasino they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount 600 on sports 1200 on slots and.

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

You Can Bet On Taxes Marcum Llp Accountants And Advisors

Ny Mobile Sports Betting Breaks Monthly Handle Record In 3 Weeks

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog

Do You Have To Pay Sports Betting Taxes Smartasset

The United States Of Sports Betting Where All 50 States Stand On Legalization

Nearly Half Of Sports Betting States Are Behind Tax Projections 1

Ct Sports Betting Connecticut Online Sportsbooks 1000 In Bonus

Information For Taxes Ct Playsugarhouse

Connecticut Gambling Revenue Highs And Lows In February

Mobile Sports Betting Operators May Not See Profits In New York State Crain S New York Business

Super Bowl Gamblers Here S Where You Can Bet How You Ll Be Taxed

Assessing State Sports Betting Structures Aaf

Connecticut Betting Guide 2022 Legal Sportsbooks In Ct

Connecticut Sportsbooks Enjoy Record Setting January

Mohegans Agree To Sharing Sports Betting With Ct Lottery

Connecticut Sports Betting Is It Legal Best Ct Betting Sites 2022